Exactly How Medical Insurance Provides Comfort and Financial Safety And Security

Health and wellness insurance policy serves as a vital system for fostering both peace of mind and economic security, particularly in an era where clinical expenses can be unexpectedly high. As we discover the numerous elements of health insurance coverage, it comes to be obvious that its influence prolongs past immediate insurance coverage, influencing lasting financial security in means that might not be instantly apparent.

Comprehending Medical Insurance Fundamentals

Browsing the complexities of health and wellness insurance coverage can usually feel frustrating; nonetheless, comprehending its fundamental elements is necessary for making educated choices regarding your healthcare. At its core, wellness insurance is a contract between a private and an insurance supplier that outlines the coverage for medical expenses for routine costs repayments.

Crucial element of health and wellness insurance policy consist of premiums, deductibles, copayments, and coinsurance. Costs are the regular monthly fees paid to maintain protection, while deductibles refer to the amount an insured individual must pay out-of-pocket prior to the insurance firm starts to cover costs. Copayments are taken care of costs for details services, such as doctor brows through, while coinsurance represents the percent of costs that the guaranteed should pay after reaching their insurance deductible.

In addition, recognizing the network of companies is crucial; insurance plans often have actually preferred networks that can influence coverage levels and out-of-pocket expenses. Acquainting yourself with the conditions of your medical insurance policy enables you to navigate the medical care system properly, guaranteeing that you obtain the essential care while managing your financial responsibilities. This fundamental knowledge is vital for making the most of the benefits of your medical insurance coverage.

Coverage for Unforeseen Clinical Expenses

Unanticipated medical expenses can occur at any kind of time, often leaving people feeling nervous about their monetary obligations. Medical insurance plays a vital duty in mitigating these unpredictabilities by supplying coverage for a broad range of unanticipated clinical expenses (Health Insurance Florida). From emergency clinic visits to hospitalization and surgical treatments, having a thorough medical insurance plan can dramatically reduce the economic worry connected with unanticipated health and wellness concerns

When an unanticipated clinical event occurs, individuals with medical insurance can access necessary treatment without the concern of inflated out-of-pocket expenditures. A lot of plans cover essential services, including analysis examinations, therapies, and expert examinations, which are important for addressing urgent wellness issues. Additionally, medical insurance usually features a cap on out-of-pocket expenses, making certain that people do not deal with impossible costs in case of a serious wellness dilemma.

Additionally, medical insurance can help with prompt access to medical services, boosting total wellness end results. By easing financial stress and anxiety related to unforeseen medical expenses, medical insurance not only sustains individuals in handling their health however also promotes a complacency and satisfaction, enabling them to concentrate on recovery as opposed to costs.

Precautionary Care and Early Treatment

Medical insurance frequently covers a range of preventative solutions, consisting of regular exams, vaccinations, screenings, and counseling. By assisting in accessibility to these solutions, insurance strategies motivate individuals to participate in positive health and wellness monitoring. Normal testings for conditions such as diabetes mellitus or high blood pressure can lead to early medical diagnosis and therapy, decreasing the risk of complications and enhancing high quality of life.

Furthermore, very early treatment approaches can aid minimize the development of persistent illness, thus minimizing the lasting problem on both individuals and the healthcare system. When people are informed and encouraged to organize their wellness, they are most likely to make healthier way of living options, contributing to a reduction in total health care costs.

Reducing Financial Anxiety and Stress And Anxiety

Maintaining health with preventative treatment not only adds to physical wellness however likewise plays a significant duty in minimizing economic anxiety and anxiety linked with healthcare costs. By buying routine exams, vaccinations, and testings, people can recognize health and wellness problems early, leading to much more efficient and much less costly treatments. This positive strategy decreases the likelihood of unforeseen clinical expenses that commonly accompany significant health and wellness problems.

Medical insurance offers a safeguard that makes certain accessibility to necessary medical solutions without the constant worry of excessively high bills. Understanding that essential healthcare is covered enables individuals to focus on their healing and overall health and wellness instead than their economic burdens. The tranquility of mind that comes from having insurance can significantly reduce stress and anxiety, allowing individuals to delight in visit their website life with higher self-confidence and safety.

Lasting Financial Planning Conveniences

Preparation for the long term can dramatically improve an individual's financial stability, specifically when it involves health care costs. By incorporating medical insurance click this link right into long-lasting financial approaches, individuals can minimize the unforeseeable costs connected with clinical treatment. This proactive strategy permits a more clear understanding of prospective learn this here now future expenses, enabling better appropriation of resources.

Wellness insurance not just covers prompt health care demands yet also plays a vital duty in safeguarding versus considerable economic problems occurring from persistent health problems or unpredicted medical emergency situations. By investing in an extensive medical insurance plan, people can secure a much more foreseeable financial future, as plans frequently include stipulations for preventive care, which can result in very early discovery of wellness issues and subsequent cost financial savings.

Moreover, lasting monetary planning that includes medical insurance encourages individuals to save better. Understanding that medical care costs are managed can liberate funds for various other financial investments, such as retirement cost savings or education and learning expenditures. Eventually, incorporating medical insurance with long-lasting financial planning fosters a holistic method to financial safety and security, enabling individuals to focus on their total wellness while guaranteeing their economic wellness remains intact.

Verdict

In conclusion, wellness insurance serves as an essential system for making certain peace of mind and economic safety. By providing insurance coverage for unforeseen medical expenditures, assisting in accessibility to preventative care, and topping out-of-pocket costs, health insurance coverage alleviates monetary stress and stress and anxiety.

From emergency area sees to hospitalization and surgeries, having a thorough health insurance coverage strategy can significantly lower the financial concern linked with unforeseen health and wellness concerns. - Health Insurance Florida

Additionally, wellness insurance commonly includes a cap on out-of-pocket costs, making sure that individuals do not deal with insurmountable expenses in the occasion of a significant health crisis.

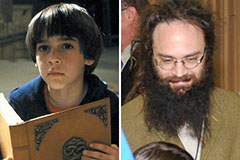

Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Mara Wilson Then & Now!

Mara Wilson Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Katie Holmes Then & Now!

Katie Holmes Then & Now! Macaulay Culkin Then & Now!

Macaulay Culkin Then & Now!